On Thursday, November 7, the chair of the Federal Reserve (Fed), Jerome Powell, announced an interest rate cut of a quarter of one percent. That news was expected, but asked if he would leave the Fed if President-elect Trump asked him to, Powell responded simply “no.” Further, he said it is “not permitted under the law” for the president to remove members of the central bank. To understand why, we need to dig back into some Georgia history.

The Federal Reserve was founded in 1913 after a group of bankers met on Jekyll Island following several bank crises in the late 19th century and early 20th. The Federal Reserve Act was signed into law by Woodrow Wilson who spent his childhood in Augusta. The Act specifies that board members of the Federal Reserve, including the chair, can only be removed “for cause.” This has traditionally been interpreted as serious misconduct or neglect, not policy differences. Economists generally agree that a central bank independent from political interference is good and research suggests more independent central banks are associated with lower inflation rates.

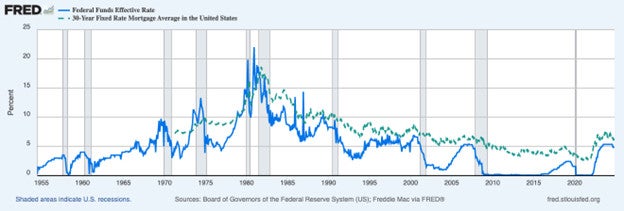

Independence within the Federal Reserve System is achieved by each of the seven governors serving nonrenewable 14-year staggered terms. Because they are nonrenewable, they are not trying to gain favor for a second term. 14-year terms allow for a longer-term economic assessment and outlook than short 4-year political cycles. It also prohibits any one president from stacking the board. These seven governors make the interest rate decision along with five regional bank presidents. They specifically control the federal funds rate, but 31% of Americans think they control mortgage rates, which they do not. Interest rates do however tend to be correlated.

The Fed is charged with a dual mandate, to maintain stable prices and maximize employment. (Only 8 percent of Americans know the Fed is tasked with maximizing employment. Slightly more, 34%, know it is tasked with stabilizing prices). An independent central bank can focus on these objectives, potentially making unpopular decisions that may have short-term consequences but longer-term benefits.

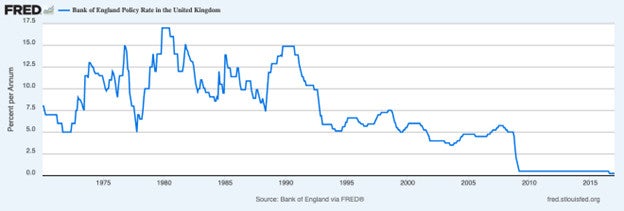

I grew up in England in the 1980’s when interest rates were set by politicians. Interest rates generally declined before elections, providing a feel-good factor, and rose after them. The graph below shows how interest rates varied over the political cycle. After Margaret Thatcher won the election in 1979, interest rates rose to 17% and then declined to about 10% in the run-up to the 1983 election. After the election, interest rates rose to 14% before declining as the 1987 election approached. They then increased to 15% and declined before the 1992 election. The Bank of England was given independence in 1997, and interest rates have generally been lower than in the previous two decades. Most large central banks throughout the world are now independent, and for good reason.